Mr Paul Chan, Financial Secretary, Hong Kong SAR

Ms Catherine So, CEO, SCMP

Mr Kevin Huang, COO, SCMP

Ms Tammy Tam, Editor-in-Chief, SCMP

Ms Zuraidah Ibrahim, Executive Manging Editor, SCMP

Ladies and Gentlemen,

Good morning

1. Thank you for inviting me here to speak at this Conference.

Region’s Growth Trajectory

2. I have been asked to share my thoughts on the challenges and opportunities for Southeast Asia, as China re-opens after the pandemic.

3. My view on this region’s economic potential can be stated in a very summary way – The secular trend for this region is only one way, up. And that is barring a serious war, a major conflagration, or other similar events.

4. You look at the trends, you look at the relevant facts, factors.

5. Based on World Bank figures, if you look at it over the last 10 years, the annual growth in East Asia and the Pacific was 4.4% on average. The global average was 2.7%.

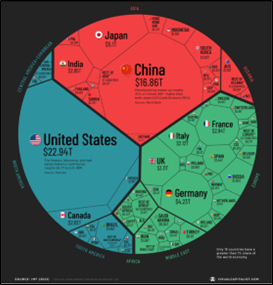

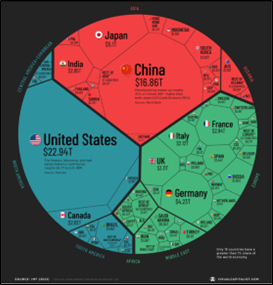

6. Today, several Asian countries are among the leading economies in the world. China – 2nd largest; Japan – 3rd largest; India – 5th or 6th, depending on the matrices that you use; South Korea – the 10th; and that’s without including Australia, which I think is 13th.

7. So, if you look at this pie chart, the economies shaded in red represent Asia-Pacific.

8. And that red part will continue to grow very strongly. And in Asia Pacific, the growth story has some way to go. And specific to China, my views on its rise, the momentum, and what I think about the possibility of “containing China”, was set out in a speech I gave in Washington in 2012 as then-foreign minister.

9. So, you can have short term ups and downs, recessions, and so on. But the basic factors for success will push this region forward:

• Substantial population sizes;

• Hardworking populations;

• Resources in this region;

• Relatively high-quality education in many countries, and the ability to access technology through that high quality education; and

• Strong cultural traditions that encourage savings and hard work.

10. All of these point to what I’ve talked about – the secular trend.

11. And ASEAN, specifically, as you’ve heard from Catherine, was the 5th largest economy in the world, in 2021. It had a combined GDP of more than US three trillion dollars, and that is growing strongly.

12. It is expected to be the 4th largest world economy, by 2030. It has a young and dynamic population – 650 million people, 60% of whom are under 35.

13. In saying this, I don’t overlook the challenges, and there are many:

• The attempts to roll back globalisation and free trade;

• The splintering of supply chains. On shoring, even when the costs are higher; the friend shoring; the outright protectionism;

• The forming of antipathic trading blocs; and

• The rise of populism, which drives some of the above.

14. The risks are serious. We see the world being seen as divided into two blocs with the Global South watching anxiously.

15. Blocs with military echoes are forming, and there is now far less talk of free trade and connectivity, though the facts underlying this talk, the reality is that trade is continuing to boom.

16. If I can refer to Gideon Rachman, in yesterday’s Financial Times, whose views I respect, he pointed out the parallels between the situation today and the situation in the 1930s – where two powers, one in Europe and the other in East Asia, were deeply dissatisfied with the then-existing world order. He calls it a gloomier parallel than some of the other descriptions that have been made.

17. The world can easily slide into a global conflict.

18. He says, and I quote, “the outbreak of war in Europe, combined with the rise in tensions in East Asia, and the growing connections between the two theatres, still has the distinct echoes of the 1930s.”

19. It is going to require responsible leadership on all sides to make sure that the tensions are managed, and we don’t slide into that conflict that many people fear.

20. These are real issues.

21. But in the limited time available today, I can either speak about those issues about which much has been said, or I can speak about the value propositions of this region. I have decided to do the latter.

Opportunities for Asia

22. What are the opportunities?

23. Asia is moving fast.

24. For example, in manufacturing, as China moves up the value chain, emerging Southeast Asian economies like Vietnam and Cambodia are also moving up to fill the gaps left by China.

25. The RCEP is the world’s largest FTA – linking ASEAN and many of the Pacific economies. It provides more market access, and access to cheaper manufacturing.

26. A BCG reports estimates that by 2030, ASEAN could generate US$600 billion more per year, in manufacturing output.

27. In the services sector, Asia is also growing faster than the rest of the world. Philippines and India are major exporters of back-office business services.

28. The Asian consumer market is also the fastest growing in the world. A McKinsey report estimates that by 2030, half of global consumption will be in Asia.

29. These figures may or may not actualise, but more importantly, they speak to a trend.

30. The number of upper, and upper-middle-income households in Bangkok, Jakarta, and Manila is expected to double between now, and 2030 – within five, six years. In Ho Chi Minh City and Hanoi, it is expected to increase by four times.

31. And there is capital to support the new innovation and entrepreneurship. Asia accounts for nearly half of global investments in start-ups.

32. And many start-ups headquartered in Southeast Asia have become unicorns. A count, as of end-2022, stands at 27. Modest, but likely to increase.

33. And when you look at Asia – which are the world-class business hubs? Many will automatically refer to Dubai, Singapore, Hong Kong. And in addition, there is Mumbai, Shanghai, Tokyo – which service large economies, which are likely to become more international over time.

34. Each of these places has its own unique advantages. Whether it is geography, easy access, strong rule of law, business ecosystem, sovereignty – each has a set of advantages.

35. But the real point is this – all of these cities will do well, within their context. Asia is going to be a huge economic giant – so diverse, so widespread geographically, that you will need several successful business centres.

Hong Kong vs Singapore

36. Let me now say a few words about many people’s favourite topic, and a topic that the media loves – which is Hong Kong and Singapore – which I personally think is rather hyped up.

37. The story is Singapore versus Hong Kong – two Asian Tigers, financial hubs, competing against each other. And the narrative is that only one can benefit at the other’s expense.

38. Media loves this because it makes for better headlines.

39. The truth, I think, is a little different, and rather less dramatic because each has its strengths. Each has its hinterland, and both can do very well.

40. But that doesn’t make for catchy headlines.

41. My view – a lot of this talk is simplistic, without deeper analysis.

42. So, let’s look at some basic points.

Hong Kong

43. Hong Kong has strong links to the Chinese hinterland, and close financial integration with the mainland.

44. This has helped it become one of Asia’s largest equity markets – over 75% of Hong Kong Stock Exchange’s market capitalisation is accounted for by mainland companies.

45. It is the largest offshore yuan centre, a leading Asian asset and wealth management hub. And it has many initiatives, bringing capital and wealth from the mainland.

46. The GDP of the Greater Bay Area is now at about US$2 trillion and undoubtedly will grow. And Hong Kong is smack in the middle of that vibrant economic region.

47. And Beijing wants Hong Kong to succeed. And that counts for a lot.

48. I have talked about Hong Kong’s attraction as a centre within China. It obviously also has a much larger role as an international business centre. And I am sure the Financial Secretary will be better-placed than I to speak about that.

49. So, some of this talk about Hong Kong being in terminal decline, that it does not have democracy, and so on, leaves me bemused.

50. Financial institutions and the related ecosystems will go where they can make money.

51. I have never believed in the pessimistic views that were, are being peddled about Hong Kong, and I have said so consistently, including in an interview I gave to SCMP at the height of the protest in 2019. So, I have been consistent in saying this. In fact, the SCMP interviewer was surprised at my views at that time.

52. Many of the factors necessary for Hong Kong to continue to succeed – are present.

53. Of course, as I said earlier, everything I say is premised on there being no major disruptions – internal, or external – like a war, or major political upheavals. And the same goes for Singapore.

Singapore

54. If we turn to Singapore – we are a gateway for international capital to Asia, particularly for those looking to invest in Southeast Asia.

55. We are a node for fixed income, insurance, currencies and commodities, and asset management, amongst others.

56. We are one of the top FinTech centres globally. And, we are building up a sustainable finance ecosystem to help channel green finance, green capital, to the rest of the region.

57. In Southeast Asia, we are a key hub for trading, finance, aviation, professional services, and shipping.

58. We are a launchpad for companies that want to do business in the region.

59. We have a network of 27 Free Trade Agreements.

60. And the strong legal frameworks that we have here – the strong protection for intellectual property rights, and being the top centre in Asia for alternative dispute resolution, arbitration and mediation makes Singapore very attractive.

61. Today, Singapore sits in an excellent position, GDP of nearly US$400 billion, relative to our citizen population of 3.6 million, and land area of 728km2. It’s quite extraordinary, the story of Singapore.

62. There is no secret to these things. It’s basically, governance and stability – which Hong Kong has, which Singapore has.

63. In Asia, Singapore was always a great place to invest.

64. Post-COVID, the common consensus was that Singapore has emerged even stronger out of COVID. And it’s one of the places to be, not just in Asia, but in the world.

65. Our handling of COVID – a lot of people found that their money was safe and they were safe, with a world-class healthcare system and rational policies.

66. Investors from all over the world are looking at Singapore. And if you look at net inflows of Assets Under Management into Singapore, a report released in November last year said nearly S$450 billion dollars of inflow in 2021 alone; and a steady increase from about S$200-260 billion pre-COVID. Looking at family offices, there has been a 75% increase since end-2020; from 400 offices then, to 700.

67. Before COVID, Singapore’s natural hinterland was Southeast Asia.

68. Post COVID – the world, the West, the Americas, are looking at Singapore as a top destination.

69. And we are in a very strong position to continue to be attractive, because the people know, the investors know, that the Government has the mandate to make Singapore investor-friendly. That mandate is, in turn, based on delivering good outcomes for Singaporeans.

70. Investors have always had to consider these factors. Because if you invest, and the policies change because the population is unhappy, then you are in a difficult situation.

71. So, if you ask why the politics in Singapore is so stable, I’ll show you some outcomes which are the result of governance, because that helps you understand what makes Singapore tick.

72. You look at education – [the Programme for International Student Assessment (PISA) scores] we are at number two, after China. If you look at the outcomes and expenditure, we have probably spent the least amount in the OECD countries, and our outcomes are the best.

73. And if you look at healthcare, again, we spend the least among the top OECD countries, but the outcomes are the best – slightly below Japan.

74. Law and order – same. And if you look at housing, home ownership rates are at 91%, one of the highest in the world, with median multiple affordability of less than six years. In fact, much less than six years generally. So, that makes Singapore stable.

75. As long as two conditions are fulfilled. One, Asia – or at least significant parts of it grows; and two, Singapore remains sensible on its employment, tax and business policies. We will do very well.

76. So, by virtue of the geography of both places, and what Hong Kong and Singapore have built ourselves into – both can, and I think, will, do very well. It is never a zero-sum game.

77. But as I said earlier, pugilistic references make for better stories.

78. And, between Singapore and Hong Kong – our economies are closely intertwined. Hong Kong is Singapore’s fifth largest trading partner, and Singapore is Hong Kong’s fourth largest trading partner.

79. Both of us benefit from each other growing and bringing vibrancy to this entire region.

80. And, the suggestion that Singapore has supplanted or is supplanting Hong Kong gives too much weight to short term factors.

81. In recent years, Hong Kong has been in transition. There is a recalibration of its position, vis-à-vis China.

82. But the analyses of that recalibration, and the 2019/2020 protests, have been far too skewed, in my view.

Media Coverage

83. I can illustrate what I mean by showing you how some media have covered events.

84. This is on the protests in LegCo and Capitol Hill. When it is Hong Kong, the headlines are “Jeremy Hunt backs Hong Kong citizens’ right to protest”. When it is Capitol Hill, “UK political leaders condemn violence at US Capitol”. Same newspaper. When they do it in Hong Kong, they are “citizens” who had the “right to protest”. But when it happens in the US, there was condemnation of the “violence” at the US Capitol.

85. What is the difference between the two situations?

86. If you look at the BBC, in Hong Kong they are “pro-democracy activists” taking “necessary action” against a “controversial new law”. But in Brazil, they were a “mob” that caused “widespread destruction”.

87. If you look at CNN, when it happens in Brazil and the US, it is “insurrection”, “rioters”, “mobs”. If it happens in Hong Kong, or Sri Lanka, it is “historic victory for the protestors”, “march for democracy”. The President of Sri Lanka at that time had been elected with 60% of the popular mandate.

88. So, you can see, how the media’s bias is reflected and that then builds up a perception – continuous, regular, unceasing.

89. That is then built into further headlines about Hong Kong. In many ways, I think Hong Kong has been a collateral casualty of an anti-China mood in some parts of the world and their media.

90. As Home Affairs Minister in Singapore, I was a keen observer of how the protests in Hong Kong were unfolding, dealt with, and covered. Every police action was deemed an attack on democracy activists. Persons who burnt and destroyed property, who attacked the police, were celebrated as democracy activists.

91. The hypocrisy in all of this – that not many had commented or commenting about the lack of democracy in Hong Kong until 1997, or that it did not affect Hong Kong’s success and vibrancy. After 1997, many suddenly had an attack of democracy consciousness.

92. But in spite of this, I believe the smart money will look beyond the media narrative and effects of periods of transition.

93. And they will know the trend for Hong Kong is clearly up. It will be more integrated with the mainland, politically and economically. And it is a Hong Kong which will compete with other Chinese cities, and which is extremely well-placed to benefit from the growth of the mainland.

94. I mentioned earlier that the size of the Greater Bay Area that Hong Kong is located within – US$2 trillion. Beijing has said that it envisions Hong Kong to be the finance, shipping, trading, and aviation hub for the entire area.

95. The fundamentals are strong.

96. So, does Hong Kong remain a good place to do business?

97. The results will speak for themselves.

Conclusion

98. This year, with China and Hong Kong re-opening, confidence is returning.

99. Some of the broader geopolitical challenges I have referred to, have no easy answers in the near horizon. They depend on the US and China finding some accommodation.

100. Meanwhile, the opportunities are there, and I am sure many will see the promise in our region.

101. I wish you all a fruitful conference. Thank you.